| Stockholder Rights | | | Stockholder RightsStructural Protections

| | | | | ✓ | Annual Election of All Directors | | ✓ | 89 of 910 Director Nominees are Independent

| ✓ | Majority Voting for Directors in Uncontested Elections, with Mandatory Director Resignation Policy | | ✓ | Lead Independent Director | ✓ | Annual Say-on-Pay Voting | | ✓ | Executive Sessions without Management | ✓ | No Stockholder Rights Plan (Poison Pill) | | ✓ | Board and Committee Risk Oversight | ✓ | Proxy Access (3/3/20 up to the greater of 2 Directors or 20% of the Board) | | ✓ | Minimum ShareStock Ownership Guidelines for Directors and Executive Officers | ✓ | Right to Select Federal Forum in any State to Bring Federal Securities Actions | | ✓ | Code of Business Conduct and Ethics for Directors and Employees | ✓ | Proposed Stockholder Right to Amend Bylaws (Recommended—See Proposal No. 4)

| | ✓ | Annual Board and Committee Self

Evaluations | ✓ | Policy on Company Political Spending | | ✓ | Anti-Hedging and Anti-Pledging Policies | ✓ | Frequent and Robust Stockholder Engagement Efforts | | ✓ | Clawback Policy |

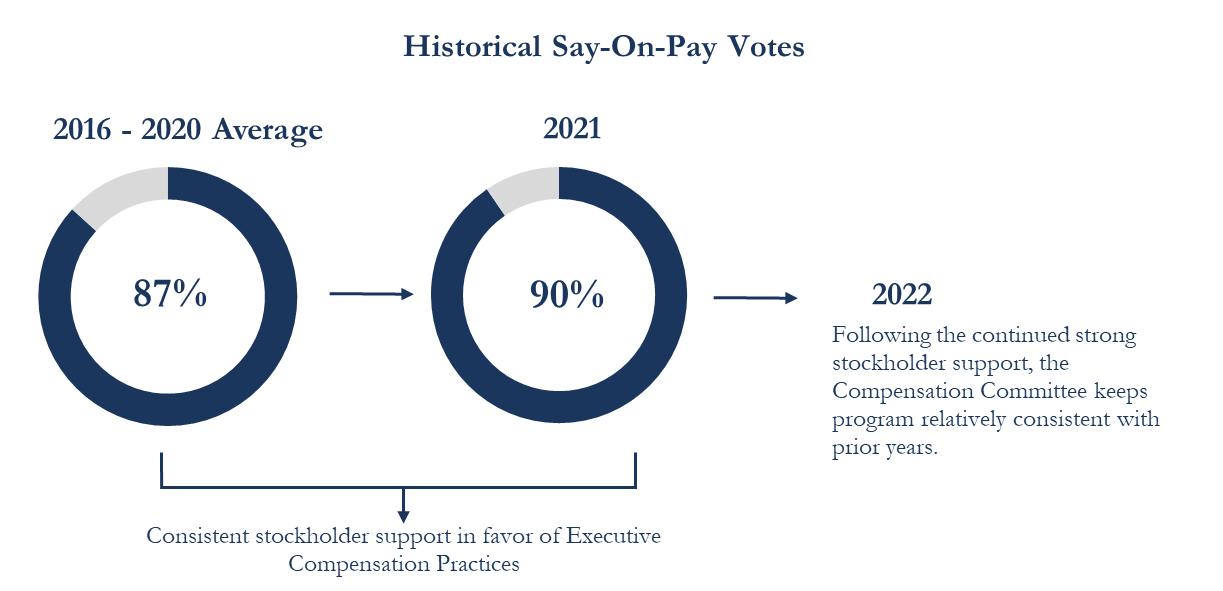

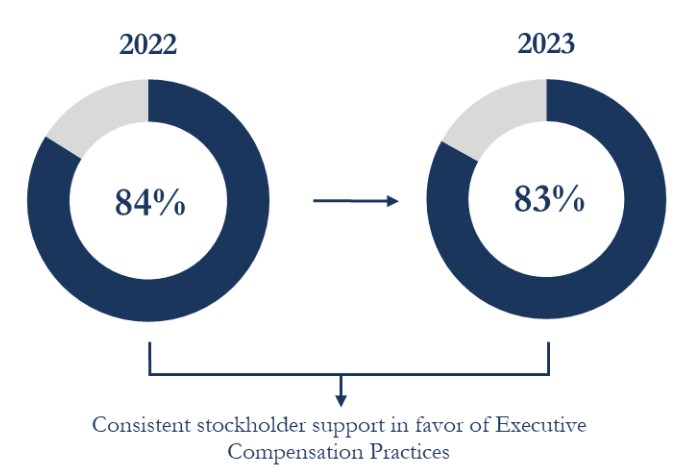

Stockholder Engagement The Board and management believe that engaging in stockholder outreach is an essential element of strong corporate governance. We strive for a collaborative approach to issues of importance to investors and continually seek to better understand the views of our investors on key topics affecting our business. Historically, we have done that on a regular basis throughout the year as management engages in communications with our investors to ensure that management and the Board understand and consider the issues that are important to our stockholders. For example, in 2021,2023, in addition to the public question and answer sessions occurring immediately after our four earnings calls, we presented at industry conferences and held non-deal road shows where we met with 88132 investors over the course of the year. These investors and analysts heard presentations from our senior management about all aspects of our business including business results and initiatives, strategy, and capital structure (which presentation materials were also made available to our stockholders generally through our filings with the SEC or on the “Investors” section of our website at www.pgre.com). Each quarter, our chairman summarizes these meetings and any feedback received for our Board. 6| ir.pgre.com

|

|

|

CORPORATE GOVERNANCE MATTERS

AtSince late 2021, we have also been reaching out to the stewardship teams of many of our larger stockholders on an annual basis, in part to help ensure that we are appropriately engaging on non-economic issues, such as those which drive our ESG performance as well. The genesis for this was that at our annual meeting in May 2021, the members of our Nominating and Corporate Governance Committee received significantly lower support than the rest of our Board, and Mark Patterson, the chairman of that committee and also our lead independent director, received a “For” vote from only 44% of the votes cast at the meeting. Pursuant to our Corporate Governance Guidelines, any director who fails to receive majority support in an uncontested election is required to tender his resignation to the Board. Accordingly, Mr. Patterson offered to tender his resignation immediately after the 2021 annual meeting, which took place on May 13, 2021. As reported in the Form 8-K that we filed on May 17, 2021, the Board rejected Mr. Patterson’s offer and reappointed him to serve as a director for the term expiring at the upcoming annual meeting in 2022 and until his respective successor has been duly elected and qualified or until his earlier resignation or removal. Our Board firmly believes that Mr. Patterson has been, and will continue to be, and integral member of our Board given his extensive experience working with public companies in the real estate industry as well as experience on the boards of directors of public companies. The Board also indicated that Mr. Patterson would continue to serve on the Nominating and Corporate Governance Committee. However,In response, the Board directed the Company to specifically engage itswith stockholders on any issues that may have contributed to this lower support. The charge for us, in a word, was to “listen,” and we did.

What we have heard, then and since, and the Board-level discussions that these conversations have engendered, have caused us to make a number of meaningful changes to various of our corporate governance practices and related disclosures, as well as to enhance and to continue focus on our Board-level diversity, as reported in our 2022 and 2023 proxy statements. | | | |

| 2024 Proxy Statement |5 |

CORPORATE GOVERNANCE MATTERS

This year’s outreach discussions were again primarily led stockholders to vote against Mr. Patterson. To this end, starting in fall 2021 and continuing into early 2022,on behalf of the Board by Greg Wright, an independent director and a memberthe Chair of theour Compensation Committee who has also served on our Nominating and Corporate Governance Committee, on behalf of the Board,Committee. Mr. Wright worked with our senior management team and investor relations professionals and extended an offeroffered to meet one-on-one with the governance teams of each of our top institutional stockholders based on information publicly available at that time.available. In these conversations,2023, we discussed our ESG performance in general, and emphasized the governance issues highlighted below, many of which the Board had deliberated on previously given the negative recommendations from leading proxy advisory firms on members of the Nominating and Corporate Governance Committee in recent years. By February 2022, we had met (or offered to meet) with major investors representing more than 53%half of our outstanding common stock (excluding stockholders represented on, or affiliated with stockholders represented on, our Board) to discuss, amongst others, the following issues:

| ● | Mark Patterson’s Suitability and Performance as a Director |

We listened to, and nearly all of our stockholders “  ”, and then shared the feedback received during our outreach process with the Board to make meaningful changes to certainover 1% of our corporate governance practicesoutstanding shares.

While these conversations initially focused on our ESG performance in general, they also gave us an opportunity to listen for whatever else was “top of mind” for these stockholders. This year, for example, we had the opportunity to also address our compensation approach and related disclosures as a direct result ofcybersecurity plans when these engagements. topics arose during these discussions. We have again summarized in the table below the major themes that we believe developed during these discussions,topics discussed this year and our response. In addition, we have included a reference to these outreach communications—by reference to the engagement symbol: “  ” — in various sections of this proxy statement that summarize our positions and/or actions taken with respect to each of these matters.responses. In some cases, after deliberating, the Board was able to respond to a stockholder concern on its own initiative—for example, adopting proxy access. Other matters, such as adoption of our proposed enhanced bylaw amendment provisions, will require stockholder approval. See Proposal 4.

|

| 2022 Proxy Statement |7

|

CORPORATE GOVERNANCE MATTERS

Below is a summary of some of the feedback we received from stockholders and what we did to respond:

| | | WHAT WE HEARD | | WHAT WE DID | Mark Patterson’s SuitabilityBoard Composition and Performance as a Director

| ●

Stockholders generally had no issues with Mr. Patterson and none of the stockholders we surveyed indicated they had voted against Mr. Patterson because of issues with respect to his qualifications or credentials as a Board member.

●

Mr. Patterson lack of support was generally driven by his position as Lead Independent Director and Chair of the Nominating and Corporate Governance Committee, which is otherwise responsible for changes to the governance issues identified below.

●

Several stockholders indicated that support for Mr. Patterson was withheld as a result of insufficient progress and/or disclosure surrounding the Board’s stance on having racial and ethnic diversity on public company boards.

●

Another stockholder indicated that they had some concern with Mr. Patterson being “overboarded” from their perspective, based on their internal policy that required counting chair positions as a separate directorship. They encouraged us to provide more information in writing on Mr. Patterson’s availability to prepare for and attend meetings and his competing time commitments in order to rebut their presumption.

●

Several stockholders suggested that we list, in one place, important stockholder rights.

|

| ●

We explained to the stockholders why the Board continues to view Mr. Patterson as a valuable contributor with a tremendous skillset. See Mr. Patterson’s biographical information and list of credentials in the skills matrix provided under “Corporate Governance Matters—Identification of Director Candidates.”

●

We had an opportunity to explain our views on diversity, by gender, race and experience, and ongoing plans to consider addition of a racially or ethnically diverse director. Subsequent to our meeting, these efforts have resulted in nomination of our first racially and ethnically diverse director (see proposed director slate below).

●

We highlighted Mr. Patterson’s significant commitment to our Board, including attending 100% of Board and committee meetings during 2021 and 2020, demonstrating his commitment and time to fulfil his duties on our Board and the committee on which he serves.

●

Our Nominating and Corporate Governance Committee closely examined our longstanding positions and made appropriate recommendations to the Board concerning conformance to stances taken by the major proxy advisory firms relating to governance issues such as stockholders’ ability to amend bylaws, proxy access, racial and ethnic diversity, and forum selection.

●

Our Board acted on these recommendations to make several important stockholder-friendly changes described in this proxy statement. See discussions marked with this symbol “  ” throughout and the newly enhanced list of stockholder rights provided in the table above.●

In summary, our Board has re-nominated Mr. Patterson to be elected at the annual meeting because they continue to view him as a valuable member of the Board with adequate availability to serve notwithstanding other commitments.

|

|

|

|

8| ir.pgre.com

|

|

|

CORPORATE GOVERNANCE MATTERS

| | | WHAT WE HEARD

|

| WHAT WE DID

| Board-Level Diversity

| ● Stockholders were generallycontinued to be supportive of our efforts to include women on our Board historically, and of the high level of diversity hiring and workforce demographic disclosure provided in our 2021 Sustainability Report. ●

Stockholders were also supportive ofprocess we follow generally when considering director nominees, including the use by our Nominating and Corporate Governance Committee procedures that require we include racially or ethnically diverse candidatesof a background and skills matrix to help ensure an appropriate diversity of skills and thought leadership on our Board. We first implemented internal use of this formal matrix, as well as its disclosure in any searches for new directors whenever diversity is lacking.our proxy statement, as a result of our 2021 outreach efforts.

● Several major stockholders nonetheless indicated that addingDuring our most recent discussions, a raciallystockholder requested additional information about how we determine whether our directors have a particular skill or ethnically diverse director was important to them and asked us to describe our views on diversity and efforts to do so.

●

Several other stockholders suggested thatexperience, which we provide more transparency about not only our directors’ work experience, but also their skills and demographic characteristics so as to give stockholders additional insights into the overall diversity of skills on the Board.provided.

|

| ● Our Nominating and Corporate Governance Committee has a robust process in identifying appropriate director candidates to our Board. See “Corporate Governance Matters—Identification of Director Candidates” for a description of how we value diversity of background and experience on our Board and a description of all factors that we consider in nominating directors.

●

In light of the current lack of racially or ethnically diverse candidates on our Board and the feedback received from stockholders, our Board retained an independent search firm to identify a pool of qualified and racially or ethnically diverse candidates for possible service starting in 2022 and beyond.

●

That effort has resulted in the Board nominating Hitoshi Saito, a racially and ethnically diverse nominee, to stand for election at the 2022 annual meeting of stockholders.

●

The Board, during its deliberations, has also expressed a willingness and desire to have additional racially or ethnically diverse director(s) added to the Board in the future.

●

In this proxy statement, we have supplementedcontinued to supplement our standard director biographies with a detailed skills and experience matrix with information about each nominee,our nominees, including gender, racial/race/ethnicity, age and tenure information. For 2023, we have added additional disclosure about the process of soliciting our directors’ input concerning their racial and gender self-identification, and their skills and experience levels. See “Corporate Governance Matters—Board Skills and Experience”, and “—Board Nominees Composition and Attributes.” | | |

| Compensation Program | ● Several stockholders wanted to understand our overall compensation philosophy and approach. They were generally supportive of our attempts to take a long-term view of employee retention, as evidenced through the acceleration into 2023 of certain equity grants that would otherwise have been granted in early 2024 and 2025, subject to appropriate safeguards. | | ● We had an opportunity to address these issues with some of the governance teams where prior discussions had focused on more traditional ESG issues. For additional details on our overall approach and the referenced equity grants and related vesting conditions, see “Compensation Discussion and Analysis” below. | | | |

6| ir.pgre.com |

| |

CORPORATE GOVERNANCE MATTERS

|

| 2022 Proxy Statement |9

|

CORPORATE GOVERNANCE MATTERS

| | | WHAT WE HEARD | | WHAT WE DID | Bylaw AmendmentsOther ESG Matters

| ● Stockholders continued to be complementary of our overall ESG performance, where we have been recognized as a clear industry leader based on the relatively high ratings that we have achieved now for several years, particularly in terms of “E” and “S,” but also increasingly in the “G” area with our recent attention to many governance aspects as detailed in the checklist above. ● One stockholder asked us to consider lowering the threshold for stockholders to be able to call a special meeting of the stockholders from a majority of the outstanding shares entitled to vote to 25%. ● Several stockholders generally viewed their abilityasked us to proposediscuss our cybersecurity program, including senior management and amend a company’s bylaws favorably, as opposedBoard oversight, and asked whether we would be able to vestingcomply with recently promulgated SEC disclosure requirements in this power solely with the Board.area. |

| ● We explainedFor more information on these practices, please see our positionpast ESG Reports at www.pgre.com, and the report we expect to release in 2024. The ESG Reports are not part of the proxy solicitation materials, and the information found on, the issue to stockholders, including why the Board believed that amendingor accessible through, our website is not incorporated into, and does not form a company’s bylaws was considered to be a matter under the Board’s purview.part of, this proxy statement.

● We highlighted that unlike many other companies bylaws where their boards could unilaterally changehave examined the bylawsgeneral practice in this manner,area for over 120 other publicly-traded REITs and note that approximately 60% of those REITs appear to maintain the same majority threshold that we do, and note that this is consistent with various elections specifically permitted under the statutory framework for corporations in Maryland, where we are incorporated. More important, however, we believe that this threshold is appropriate for us given the current concentration of our bylaws actually givestockholder base into a relatively small number of larger holders. In this regard, consider that as of mid-February 2024, the top six of our stockholders the rightheld in excess of 50% of our stock. We believe this general make-up is also consistent with historical trends in our stock holdings. Accordingly, we have not taken steps to vote on any change affecting the amendment article, so any amendment to our bylaws could only be resolved by putting it to a stockholder vote via a management proposal during proxy season.lower this threshold. ● After careful considerationWe were able to describe our extensive internal and external resources in this area, the maturity of this issue,our cybersecurity program, which has been independently assessed, vendor risk management, and in light of the constructive direct input received from our stockholders, the Nominatingrecent and Corporate Governance Committee recommended that our Board propose an amendmentplanned enhancements to our bylawsincident response plan, including the requirement to permitconduct tabletop exercises with senior management, which occurred in 2023. For more information on our stockholderscybersecurity program, including how Board-level oversight has been formally assigned to amend the bylaws.our Audit Committee through its charter, and our escalation and internal reporting protocols, see our “Annual Report on Form 10-K, Item 1C. Cybersecurity—Governance Related to Cybersecurity Risks”, and “–Cyber Risk Management and Strategy.”

●

The Board accepted this recommendation. See Proposal No. 4 below to amend and restate our bylaws to accomplish this change. The Board recommends that you vote “For” this proposal.

|

|

|

| Forum Selection

| ●

All of the stockholders we spoke to were generally supportive of our existing bylaw provision on forum selection and appreciated our willingness and ability to explain it.

●

None of the stockholders we spoke to indicated that they had voted against any of our directors on account of our position on forum selection.

|

| ●

We retained the enhanced forum selection provision adopted by our Board in 2021 because we believe it is in the best interest of our Company and our stockholders. See “Corporate Governance Highlights—Forum Selection” below.

|

10| ir.pgre.com

|

|

|

CORPORATE GOVERNANCE MATTERS

| | | WHAT WE HEARD

| | WHAT WE DID

| Proxy Access

| ●

Several of our major stockholders told us that proxy access was important to them, and encouraged us to adopt a provision, indicating that commonly accepted requirements would be acceptable.

|

| On the recommendation of our Nominating and Corporate Governance Committee, in February 2022, we amended our bylaws to provide stockholders meeting certain commonly accepted requirements listed below to be able to include director nominees in our proxy materials for annual meetings of our stockholders:

●

A proponent stockholder (or a group of up to 20 stockholders) must have owned at least 3% of our outstanding stock for three years.

●

Must meet various other procedural requirements.

●

Can nominate up to the greater of two directors or 20% of the number of directors then in office.

See “Corporate Governance Highlights—Proxy Access” for a complete description.

|

|

|

| Other ESG Issues

| ●

Our discussions with our stockholders included several topics in the environmental and social areas that were important to them.

|

| ●

For those topics not covered elsewhere in this proxy statement, we will enhance our disclosures in our upcoming 2022 ESG Report, which will be issued later this year.

|

We appreciate the time our stockholders spent engaging with us, and the candor of those discussions. Our goal is to continue these types of discussions with our stockholders on a wide range of matters, as they provide valuable feedback and enable us to address stockholder concerns and interests in designing and implementing our programs and practices. | | | |

| 20222024 Proxy Statement |117

|

CORPORATE GOVERNANCE MATTERS

Corporate Governance Guidelines We are committed to operating our business under strong and accountable corporate governance practices. The Board has adopted Corporate Governance Guidelines that address significant issues of corporate governance and set forth procedures by which the Board carries out its responsibilities. Among the areas addressed by the Corporate Governance Guidelines are director qualification standards, director responsibilities, Board structure, director access to management and independent advisors, director compensation, director orientation and continuing education, management succession, annual performance evaluation of the Board and committees, related person transaction approval and disclosure policy, and stockholder rights plan. Under the Corporate Governance Guidelines, the Company will not adopt a stockholder rights plan unless the Company’s stockholders approve in advance the adoption of a plan or, if adopted by the Board, the Company will submit the stockholder rights plan to its stockholders for a ratification vote within 12 months of adoption or the plan will terminate. Our Nominating and Corporate Governance Committee is responsible for, among other things, assessing and periodically reviewing the adequacy of the Corporate Governance Guidelines and will recommend, as appropriate, proposed changes to the Board. You are encouraged to visit the “Investors–Corporate Governance” section of our website at www.pgre.com to view or to obtain copies of our committee charters, Code of Business Conduct and Ethics, Corporate Governance Guidelines and stockholder communication policy. The information found on, or accessible through, our website is not incorporated into, and does not form a part of, this proxy statement or any other report or document we file with or furnish to the SEC. You also may obtain, free of charge, a copy of the respective charters of our committees, Code of Business Conduct and Ethics, Corporate Governance Guidelines and stockholder communication policy by directing your request in writing to Paramount Group, Inc., 1633 Broadway, Suite 1801, New York, New York 10019, Attention: Investor Relations. Additional information relating to the corporate governance of the Company also is included in other sections of this proxy statement.

Environmental, Social and Governance (“ESG”) Commitment We are dedicated to responsible environmental, social and community stewardship as an essential part of our mission to build a successful business and to shape the communities we serve throughout our portfolio, in addition to our workplace community. To learn more about our ESG initiatives, please visit the “Sustainability” section of our website at www.pgre.com,which includes links to our latest Sustainability Reports,ESG Report, a list of awards we have achieved as an environmental leader, and other important ESG policies such as our Human Rights Policy, Environmental Policy, Policy on Company Political Spending and Vendor Code of Conduct. The information found on, or otherwise through, our website is not incorporated by reference into, nor does it form a part of, the proxy statement. Our Sustainability Committee consists of a diverse group of leaders from each department including our Senior Vice President, Energy and Sustainability. The committee is chaired by Gage Johnson, our Senior Vice President, General Counsel and Secretary, and operates under a formal charter, reporting on a regular basis to our Audit Committee, which the Board has vested with oversight responsibility for all environmental and social matters, including sustainability, climate change, corporate social responsibility, and health and safety. While our annual ESG Reports (and prior to that, Sustainability Report or ESG ReportReports) may report on governance matters as well, these are overseen by our Nominating and Corporate Governance Committee. 128| ir.pgre.com

|

| |

CORPORATE GOVERNANCE MATTERS

Board Overview The following pages provide information about our Board of Directors and new Director Nomineedirector nominee standing for election, or re-election, as applicable, at the 20222024 Annual Meeting. | | | | | | | | | DIRECTOR | | COMMITTEES | NAME/AGE/INDEPENDENCE | SINCE | POSITION(S) | AC | COMP | NCG | IFC |

| Albert Behler, 7072 | Chairman

since 2014 | Chairman, Chief Executive Officer and President | | | | C |

| Thomas Armbrust, 69

71

Independent | 2014 | Director | | | ●

| ● |

| Martin Bussmann, 70

72

Independent | 2016 | Director | | ● | ●

|

|

| Karin Klein, 50

Independent

| 2016

| Director

| ●

| |

|

|

| Peter Linneman, 71

Independent

| 2014

| Director

| C | ●

| |

|

| Karin Klein, 52

Independent | 2016 | Director | ● | | | |

| Katharina Otto-Bernstein, 57

59

Independent | 2014 | Director | | | | |

| Mark Patterson, 61

63

Independent | 2018 | Director | | | C●

| |

| Hitoshi Saito, 69 71

Independent | New

Nominee2022

| Director

| | | | |

| Nadir Settles, 43 Independent | New

Nominee | Director Nominee | | | | |

| Paula Sutter, 56

Independent | 2022 | Director | ● | | | |

| Greg Wright, 57

59

Independent | 2020 | Director | | C | | ●

|

Chair C Member ●

|

| 2022 Proxy Statement |13

|

CORPORATE GOVERNANCE MATTERS

| | | |

| 2024 Proxy Statement |9 |

CORPORATE GOVERNANCE MATTERS

| | | | | | | | | | | | | | | | | | | | | | BOARD SKILLS AND EXPERIENCE | The Board believes that a complementary balance of knowledge, experience and capability will best serve the Company and its stockholders. The table below summarizes the types of experience, qualifications, attributes and skills the Board believes to be desirable because of their particular relevance to the Company'sCompany’s business and structure. In order to attribute various skills, experience levels and demographic characteristics of the director nominees, the Company has followed both objective and subjective criteria, striving first to use objective criteria for each category based on information collected from each director nominee. Each director nominee is then given an opportunity to comment on their assigned attributes for potential revision. While all of these factors were considered by the Board with respect to each director nominee, the following table does not encompass all the experience, qualifications, attributes or skills of our director nominees. More information on each director nominee’s qualifications and background is included in the director nominee biographies beginning on page 26. | Skills and Experience | | Armbrust | | Behler | | Bussmann | | Klein | | Linneman

|

| Otto-Bernstein | | Patterson | | Saito | | Settles | | Sutter | | | Wright | Company Knowledge | | l | | l | | l | | l | | l | | l | | l | | l

| | l

| | | l | Other Public Co. Board Experience | | l | | | | | | l | | l

| | l

| | l | | l

| | l

| | | | Real Estate Industry Experience | | l | | l | | l | | l | | l | | l | | l | | l | | | | | l | Other Industry Experience | | | | l | | l | | l | | l

| | l

| | l

| | l

| | l

| | | | Senior Leadership (as CEO or Business Unit Head) | | l | | l | | l | | l | | l | | l | | l | | l | | l

| | | l | International | | l | | l | | l | | | | l

| | l | | l

| | l

| | l

| | | | Human Capital Management | | | | | | l | | l | | l

| | l

| | l | | l

| | | | | l | Finance/Capital Allocation/Investment Activity | | l | | l | | l | | l | | l

| | l

| | l

| | l

| | | | | l | Accounting/Financial Literacy | | l | | l | | l | | l | | l

| | l

| | l | | l | | l

| | | l | Marketing/Sales | | | | l | | l | | | | l | | l

| | | | | | l

| | | | Environmental Science/Sustainability | | | | l | | l | | l | | l

| | | | l

| | l

| | l

| | | | Academia/Education | | | | | | | | l | | l | | l

| | | | | | | | | | Risk Management/Legal | | | | l | | l | | | | | | | | | | | | | | | | Corporate Governance | | l

| | | | l | | l | | l

| | l

| | l | | l

| | l

| | | l | Technology/Systems | | | | | | | | l | | | | | | | | | | | | | | Business Ethics | | l | | l | | l | | l | | l | | l | | l | | l | | l

| | | l | Strategic Planning | | l | | l | | l | | l | | l | | l | | l | | l | | l

| | | l | Capital Mkts/Inv. Banking | | | | | | | | | | | | l

| | l

| | | | | | | l |

| | | | | | | | | BOARD COMPOSITION AND ATTRIBUTES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | BOARD NOMINEES COMPOSITION AND ATTRIBUTES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1410| ir.pgre.com

|

| |

CORPORATE GOVERNANCE MATTERS

Board Leadership Leadership Structure Our Board currently is comprised of eightnine independent directors (one of whom wasis not nominated to standstanding for electionreelection at the annual meeting) and one non-independent director. Albert Behler, our Chief Executive Officer and President, serves as Chairman of the Board. Our Board believes that the Company and our stockholders are best served by having Mr. Behler serve as Chairman and Chief Executive Officer. Mr. Behler’s over 30 years of experience leading the Company and its predecessor and significant ownership interest in the Company uniquely qualify him to serve as both Chairman and Chief Executive Officer. In addition, our Board believes that Mr. Behler’s combined role as an executive officer and the Chairman of our Board promotes unified leadership and direction for our Board and executive management, and it allows for a single, clear focus for the chain of command to execute our strategic initiatives and business plans. Lead Independent Director To facilitate the role of the independent directors, the Board has determined that it is appropriate for the independent directors to appoint one independent director to serve as Lead Independent Director. The Lead Independent Director is currently Mark Patterson.Martin Bussmann. We believe that the number of independent, experienced directors that make up our Board, along with the independent oversight of our Lead Independent Director, benefits the Company and its stockholders. We recognize that different board leadership structures may be appropriate for companies in different situations, and that no one structure is suitable for all companies. Our current Board leadership structure is optimal for us because it demonstrates to our employees and other stakeholders that the Company is under strong leadership. In our judgment, the Company, like many companies, has been well-served by this leadership structure. The Lead Independent Director has the following responsibilities: | ● | presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of independent directors; |

| ● | serving as liaison between the Chairman and the independent directors; |

| ● | approving information sent to our Board; |

| ● | approving Board meeting agendas; |

| ● | approving Board meeting schedules to assure that there is sufficient time for discussion of all agenda items; and |

| ● | if requested by major stockholders, ensuring that he or she is available for consultation and direct communication. |

Our Lead Independent Director also has the authority to call meetings of the independent directors. We believe that the Lead Independent Director is an integral part of the Board’s structure that promotes strong, independent oversight of our management and affairs. | | | |

| 20222024 Proxy Statement |1511

|

CORPORATE GOVERNANCE MATTERS

Board Committees The Board held ninefive meetings during fiscal year 2021,2023, and all directors, except Ms. Otto-Bernstein, attended 75% or more of the board of directors meetings and meetings of the committees on which they served during the periods they served. Ms. Otto-Bernstein was only able to attend 60% of the Board meetings due to scheduling conflicts. The Board currently has the following four standing committees: | ● | Audit Committee,Committee; |

| ● | Compensation Committee,Committee; |

| ● | Nominating and Corporate Governance Committee; and |

| ● | Investment and Finance Committee. |

The Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are composed exclusively of independent directors, in accordance with the New York Stock Exchange (the “NYSE”)NYSE listing standards. The principal functions of each committee are briefly described below. The current charters for each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are available on our website at www.pgre.com under the “Investors–Corporate Governance” section. Further, we will provide a copy of these charters free of charge to each stockholder upon written request. Requests for copies should be addressed to Gage Johnson, Senior Vice President, General Counsel and Secretary, at Paramount Group, Inc., 1633 Broadway, Suite 1801, New York, New York 10019. From time to time, the Board also may create additional committees for such purposes as the Board may determine.

1612| ir.pgre.com

|

| |

CORPORATE GOVERNANCE MATTERS

| | | | | | | | | | | | Audit | Members:

Peter Linneman (Chair)

Colin Dyer

Karin Klein Paula Sutter | Meetings:

4 | | | The Audit Committee currently consists of Dr. Peter Linneman (Chair), Colin DyerKarin Klein and Karin Klein,Paula Sutter, each of whom is an independent director. Colin DyerDr. Linneman will not be standing for electionreelection at the 20222024 annual meeting. The Board has determined that Dr. Linneman qualifiesand Karen Klein qualify as an “audit committee financial expert” as that term is defined by the applicable SEC regulations and NYSE corporate governance listing standards and that each of the Audit Committee membersmember is “financially literate” as that term is defined by the NYSE corporate governance listing standards. We have adopted an Audit Committee charter, which details the principal functions of the Audit Committee, including oversight related to: our accounting and financial reporting processes; the integrity of our consolidated financial statements; our systems of disclosure controls and procedures and internal control over financial reporting; our compliance with financial, legal and regulatory requirements; the performance of our internal audit function; our overall risk assessment and management (including enterprise risk and cybersecurity); and certain environmental and sustainability matters and issues related to social responsibility.

The Audit Committee is also responsible for engaging an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, approving professional services provided by the independent registered public accounting firm, including all audit and non-audit services, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. The Audit Committee also prepares the Audit Committee Report required by SEC regulations to be included in this proxy statement. Additional information regarding the functions performed by our Audit Committee is set forth in the Audit Committee Report. The Audit Committee held four meetings during fiscal year 2021.2023. | | | | | | | |

| | | |

| 20222024 Proxy Statement |1713

|

CORPORATE GOVERNANCE MATTERS

| Compensation | Members:

Greg Wright (Chair) Martin Bussmann

Peter Linneman | | Meetings:

8

7 | | | The Compensation Committee currently consists of Greg Wright (chair)(Chair), Martin Bussmann and PeterDr. Linneman, each of whom is an independent director. Dr. Linneman will not be standing for election at the 2024 annual meeting. We have adopted a Compensation Committee charter, which details the principal functions of the Compensation Committee, including: reviewing and approving the corporate goals and objectives relevant to our Chief Executive Officer’s compensation, evaluating our Chief Executive Officer’s performance in light of such goals and objectives and determining and approving the remuneration of our Chief Executive Officer based on such evaluation; reviewing and approving the compensation of other senior officers; reviewing our executive compensation policies and plans; implementing and administering our incentive compensation and equity-based plans; assisting management in complying with our proxy statement and annual report disclosure requirements; producing a report on executive compensation to be included in our annual proxy statement; and reviewing, evaluating and recommending changes, if appropriate, to the remuneration for directors. The Compensation Committee held eightseven meetings during fiscal year 2021.2023. | |

1814| ir.pgre.com

|

| |

CORPORATE GOVERNANCE MATTERS

| | | | | | | Nominating and Corporate Governance | Members:

Martin Bussmann (Chair) Thomas Armbrust Mark Patterson (Chair)

Martin Bussmann

Greg Wright | | Meetings:

4 | | | The Nominating and Corporate Governance Committee currently consists of Martin Bussmann (Chair), Thomas Armbrust and Mark Patterson, (chair), Martin Bussmann and Greg Wright, each of whom is an independent director. We have adopted a Nominating and Corporate Governance Committee charter, which details the principal functions of the Nominating and Corporate Governance Committee, including: identifying and recommending to the Board qualified candidates for election as directors and recommending nominees for election as directors at the annual meeting of stockholders; developing and recommending to the Board corporate governance guidelines and implementing and monitoring such guidelines; reviewing and making recommendations on matters involving the general operation of the Board, including board size and composition, and committee composition and structure; recommending to the Board nominees for each committee of the Board that is required by NYSE listing rules; annually facilitating the assessment of the Board’s performance, as required by applicable laws, regulations and the NYSE corporate governance listing standards; and annually reviewing and making recommendations to the Board regarding revisions to the Corporate Governance Guidelines and the Code of Business Conduct and Ethics. The Nominating and Corporate Governance Committee held four meetings during fiscal year 2021.2023. | | | | | | | | | Investment and Finance | Members:

Albert Behler (Chair)

Thomas Armbrust | | Meetings:

2

5 | | | The Investment and Finance Committee currently consists of Albert Behler (chair)(Chair) and Thomas Armbrust. If Mr. Armbrust is unavailable, Mr. WrightSaito would serve in his place. This committee is responsible for approving certain material acquisitions, dispositions and other investment and financing decisions of the Company. The Investment and Finance Committee held twofive meetings during fiscal year 2021.2023. | |

| | | |

| 20222024 Proxy Statement |1915

|

CORPORATE GOVERNANCE MATTERS

Director Independence Our Corporate Governance Guidelines provide that a majority of our directors serving on the Board and all directors serving on the Board committees (other than the Investment and Finance Committee) must be independent as required by the listing standards of the NYSE and the applicable rules promulgated by the SEC. The Board has determined affirmatively, based upon its review of all relevant facts and circumstances and after considering all applicable relationships of which the Board had knowledge, between or among the directors and the Company or our management, that each of the following directors and the director nomineesnominee has no direct or indirect material relationship with us and is independent under the listing standards of the NYSE: Thomas Armbrust, Martin Bussmann, Karin Klein, Peter Linneman, Katharina Otto-Bernstein, Mark Patterson, Hitoshi Saito, Nadir Settles, Paula Sutter and Greg Wright. Some of the relationships considered by our board of directors are described in the section of this proxy statement entitled “Certain Relationships and Related Party Transactions.” For Ms. Otto-Bernstein and Mr. Armbrust, the Board considered the direct and indirect interests of each director in (i) the Company’s real estate funds and the distributions made by those funds, (ii) previously disclosed transactions in connection with the Company’s formation and initial public offering, (iii) a lease oftwo leases for space at 1325 Avenue of Americas, andone of which, prior to December 1, 2022, was at 1633 Broadway, to ParkProperty Capital, LP (formerly known as CNBB-RDF Holdings LP)(“ParkProperty”), (iv) a previously disclosed joint venture with an affiliate of the Company to acquire an interest in 55 Second Street and (v) the extension of the maturity of certainpreviously disclosed promissory notes entered into in connection with the Company’s formation that were owed by certain executive officers of the Company to ParkProperty, Capital, LP.the last of which were paid off during 2022. In addition, the Board considered certain additional transactions and relationships, including (i) for Dr. Bussmann and Dr. Linneman, the direct and indirect interests each director held in the Company’s real estate funds and the distributions made by those funds, (ii)(1) for Dr. Bussmann, a lease of space at 712 Fifth Avenue to a subsidiary of a trust for which Dr. Bussmann iswas, prior to December 12, 2022, a trustee of the trust and a director of the trust subsidiary, and for which his children areremain as beneficiaries, (iii) for Mr. Patterson, the prior employment of a member of his immediate family as an intern, (iv)(2) for Mr. Wright, his prior relationship with the Company in his former role at Bank of America Merrill Lynch, which was the lead investment bank for the Company’s initial public offering and (v)(3) for Mr. Saito, his prior service as a member of the Advisory Board of the Company’s operating partnership. Director Compensation The Board has established a compensation program for our non-employee directors. Our Compensation Committee reviews our director compensation at least annually and makes recommendations to the Board based on its review. For 2021, FPL Associates L.P. (“FPL”) was hired to evaluate the structure and competitiveness of our director compensation and recommend changes, as appropriate. Based on this review, our Compensation Committee recommended no changes to our Board compensation, and the full Board followed this recommendation. We pay the following fees to our non-employee directors on a quarterly basis, in cash:cash, except as noted below: | ● | an annual retainer of $65,000;$75,000; |

| ● | an additional annual retainer of $50,000 to our Lead Independent Director; |

| ● | an additional annual retainer of $25,000 to our Audit Committee chair, and $15,000$20,000 to eachthe Compensation Committee chair and $15,000 to the Nominating and Corporate Governance Committee chair; and |

| ● | an additional annual retainer of $5,000 to each committee member.member (excluding members of the Investment and Finance Committee). |

We will also reimburse each of our directors for his or her travel expenses incurred in connection with his or her attendance at full Board and committee meetings. No additional compensation is received by the members of our Investment and Finance Committee. Directors of the Company who are also employees receive no additional compensation for their services as directors. 2016| ir.pgre.com

|

| |

CORPORATE GOVERNANCE MATTERS

In December 2022, the Board adopted a Non-Employee Director Compensation Plan (as most recently amended, the “Director Compensation Plan”) which sets forth the annual cash retainers listed above, and the amount and vesting terms of the annual equity grants payable to our non-employee directors. With regard to the annual retainer of $75,000, the Director Compensation Plan also provides that each non-employee director may elect, on or before December 31 of each year, to receive such retainer in cash or equity (i.e., time-based LTIP units (“T-LTIP units”) or shares of restricted common stock as indicated below) in lieu of cash, which would typically be granted the following year on December 15, with the number of shares or units being calculated by dividing the amount of the annual cash retainer by the closing market price of the Company’s common stock on the grant date. In order to encourage our non-employee directors to acquire a significant equity stake in usthe Company and to align our non-employee directors and stockholders, at each annual stockholder meeting we will grant each of our non-employee directors LTIPT-LTIP units or shares of restricted common stock under our Amended and Restated 2014 Equity Incentive Planequity incentive plan with a value of $120,000 which will vest upon the earlier of the anniversary of the date of the grant or the next annual stockholder meeting. The following table sets forth information regarding the compensation paid to our non-employee directors during the fiscal year ended December 31, 2021:2023: | | | | | | | Name | | Fees Earned

or

Paid in Cash | | Stock

Awards (1) | | Total | Thomas Armbrust | | $ 65,000 | | $ 120,008 | | $ 185,008 | Martin Bussmann | | 73,125 | | 108,043 | | 181,168 | Colin Dyer | | 70,000 | | 108,043 | | 178,043 | Karin Klein | | 75,625 | | 108,043 | | 183,668 | Peter Linneman | | 95,000 | | 108,043 | | 203,043 | Katharina Otto-Bernstein | | 65,000 | | 108,043 | | 173,043 | Mark Patterson | | 130,000 | | 108,043 | | 238,043 | Greg Wright | | 81,250 | | 108,043 | | 189,293 |

| | | | | | | Name | | Fees Earned

or

Paid in Cash | | Stock

Awards (1) | | Total | Thomas Armbrust | | $ 76,250 | | $ 120,000 | | $ 196,250 | Martin Bussmann | | 141,250 | | 108,110 | | 249,360 | Karin Klein | | 76,250 | (2) | 108,110 | | 184,360 | Peter Linneman | | 101,250 | (2) | 108,110 | | 209,360 | Katharina Otto-Bernstein | | 71,250 | | 108,110 | | 179,360 | Mark Patterson | | 76,250 | | 108,110 | | 184,360 | Hitoshi Saito | | 71,250 | | 120,000 | | 191,250 | Paula Sutter | | 76,250 | (2) | 108,110 | | 184,360 | Greg Wright | | 89,375 | (2) | 108,110 | | 197,485 |

| (1) | On May 13, 2021,18, 2023, we granted 11,731 LTIP27,650 T-LTIP units to each of Messrs. Bussmann, Dyer, Linneman, Patterson, and Wright and Mmes. Klein, and Otto-Bernstein, and 11,731Sutter, and 27,650 shares of restricted stock to Mr.Messrs. Armbrust and Saito, under our Amended and Restated 2014 Equity Incentive Plan. Such awards will vest if they remain on our Board until the 20222024 annual meeting. Amounts shown reflect the aggregate grant date fair value of LTIPT-LTIP units or shares of restricted stock issued to each director as determined pursuant to Financial Accounting Standards Board’s Accounting Standards Codification Topic 718 “Compensation—Stock Compensation” (“ASC Topic 718”), disregarding the estimate of forfeitures. The assumptions we used for calculating the grant date fair values are set forth in Note 1817 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2021.2023. As of December 31, 2021,2023, each of Messrs. Bussmann, Dyer, Linneman, Patterson, and Wright and Mmes. Klein, Otto-Bernstein and Otto-BernsteinSutter held 11,73127,650 unvested LTIPT-LTIP units that had been granted by us as director compensation. As of December 31, 2021, Mr.2023, Messrs. Armbrust and Saito held 11,73127,650 unvested shares of restricted stock that had been granted by us as director compensation. |

| (2) | Includes annual cash retainer of $71,250, which was exchanged for 12,769 vested LTIP units that were granted on December 15, 2023, based on an election made by the respective non-employee director in December 2022. |

| | | |

| 20222024 Proxy Statement |2117

|

CORPORATE GOVERNANCE MATTERS

Code of Business Conduct and Ethics Our Board has established a Code of Business Conduct and Ethics that applies to our officers, directors and employees. Among other matters, our Code of Business Conduct and Ethics is designed to deter wrongdoing and to promote: | ● | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| ● | full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; |

| ● | compliance with laws, rules and regulations; |

| ● | prompt internal reporting of violations of the code to appropriate persons identified in the code; and |

| ● | accountability for adherence to the Code of Business Conduct and Ethics. |

Any waiver of the Code of Business Conduct and Ethics for our directors or officers may be made only by our Board or our Nominating and Corporate Governance Committee, and will be promptly disclosed as required by law or NYSE regulations. We intend to disclose on our website any amendment to, or waiver of, any provisions of our Code of Business Conduct and Ethics applicable to our directors and executive officers that would otherwise be required to be disclosed under the rules of the SEC or the NYSE. Communications with the Board We have a process by which stockholders and other interested parties may communicate with the non-employee directors, both individually and as a group, through the Board’s Lead Independent Director. In cases where stockholders or other interested parties wish to communicate directly with non-employee directors, messages can be sent in writing or by email to: Lead Independent Director, Paramount Group, Inc., c/o Navex Ethics Hotline (“Navex”) using the following link: www.paramount-group.ethicspoint.comwww.pgre.ethicspoint.com, or any other link to or toll-free number of a third party reporting service approved by the Lead Independent Director from time to time and posted on our website in our Stockholder Communications Policy, which can be found in the “Investors/Corporate Governance” section or as may be otherwise appropriately disseminated. Navex acts as agent for the Lead Independent Director in facilitating direct communications to him and any other non-employee directors he requests. Any such communications may be made anonymously. Audit Committee Complaint Procedures Our Audit Committee has established procedures for (i) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal controls or auditing matters and (ii) the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. If you wish to contact our Audit Committee to report complaints or concerns relating to the financial reporting of the Company, you may do so in writing to the Chairperson of our Audit Committee, c/o Navex using the following link: www.paramount-group.ethicspoint.comwww.pgre.ethicspoint.com, or the toll-free number provided in the link, or any other link to or toll-free number of a third party reporting service approved by the Chairperson of the Audit Committee from time to time and posted on our website or otherwise appropriately disseminated. Any such communications may be made anonymously. 2218| ir.pgre.com

|

| |

CORPORATE GOVERNANCE MATTERS

Director Attendance at Annual Meetings We encourage each member of the Board to attend each annual meeting of stockholders. All of our directors serving at that time attended, in person or by teleconference, the annual meeting of stockholders held on May 13, 2021.18, 2023, except Ms. Otto-Bernstein, who was not able to attend. Identification of Director Candidates Our Nominating and Corporate Governance Committee assists the Board in identifying and reviewing director candidates to determine whether they qualify for membership on the Board and recommends director nominees to the Board to be considered for election at our annual meeting of stockholders. Our Nominating and Corporate Governance Committee has adopted a written policy on the criteria and process of identifying and reviewing director candidates. At a minimum, the Nominating and Corporate Governance Committee must be satisfied that each director candidate (i) has experience at a strategic or policymaking level in a business, legal, accounting, government, non-profit or academic organization of high standing, (ii) is highly accomplished in his or her respective field, (iii) is well regarded in the community and shall havehas a reputation for the highest ethical and moral standards and (iv) has sufficient time and availability to devote to the affairs of the Company, particularly in light of the number of boards on which the nominee may serve. In this regard, the committee has considered the skills and experiences of each director candidate as set forth above under “Board Skills and Experience”. In addition to the minimum qualifications for each nominee set forth above, the Nominating and Corporate Governance Committee must recommend that the Board select persons for nomination to help ensure that (i) a majority of the Board will be “independent” in accordance with the standards established pursuant to Section 303A of the NYSE Listed Company Manual, (ii) each of its Audit, Compensation and Nominating and Corporate Governance Committees will be comprised entirely of independent directors and (iii) at least one member of the Audit Committee will have accounting or related financial management expertise. Finally, in addition to any other standards the Nominating and Corporate Governance Committee may deem appropriate from time to time for the overall structure and composition of the Board, the Nominating and Corporate Governance Committee may, but is not required to, consider (i) whether the nominee has direct experience in the real estate industry, particularly in the office real estate industry, or in the markets in which the Company operates, and (ii) whether the nominee, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience. In this regard, the Nominating and Corporate Governance Committee’s procedures require it to ensure to the greatest extent practicable that the pool of prospective candidates that it considers to fill any vacancy or additional director position includes one or more female candidates or one or more racially or ethnically diverse candidates if, at such time, the Board is lacking gender diversity or racial/ethnic diversity, respectively. Our Nominating and Corporate Governance Committee may consider director candidates recommended by our stockholders. Our Nominating and Corporate Governance Committee will apply the same standards in considering candidates submitted by stockholders as it does in evaluating candidates submitted by members of the Board. Any recommendations by stockholders are to follow the procedures outlined under “Stockholder Proposals” in this proxy statement and should provide the reasons supporting a candidate’s recommendation, the candidate’s qualifications and the candidate’s written consent to being considered as a director nominee. As previously disclosed, we have entered into a stockholders agreement with Maren Otto, Katharina Otto-Bernstein and Alexander Otto providing these members of the Otto family with the right, collectively, to designate up to three director nominees to our Board. The number of director nominees that these members of the Otto family will have the right to designate may be reduced in the future based on reductions in the percentage of our total outstanding common stock owned by these individuals, their lineal descendants or entities they own or control collectively. Albert Behler, Thomas Armbrust and Katharina Otto-Bernstein have been designated for nomination to our Board pursuant to the stockholders agreement.

| | | |

| 20222024 Proxy Statement |2319

|

CORPORATE GOVERNANCE MATTERS

Proxy Access As a resultpart of our stockholder engagement efforts noted above and our commitment to corporate governance, onin February 18, 2022 we amended our bylaws to adopt a proxy access right for stockholders, pursuant to which a stockholder, or group of no more than 20 stockholders, meeting specified eligibility requirements, may include director nominees in our proxy materials for annual meetings of our stockholders. In order to be eligible to utilize these proxy access provisions, a stockholder, or group of stockholders, must, among other requirements:

| | | • |

| have owned shares of common stock equal to at least 3% of the aggregate of the issued and outstanding shares of common stock continuously for at least the prior three years; | | | | • |

| represent that such shares were acquired in the ordinary course of business and not with the intent to change or influence control and that such stockholder or group does not presently have such intent; and | | | | • |

| provide a notice requesting the inclusion of director nominees in our proxy materials and provide other required information to us not earlier than 150 days nor later than 120 days prior to the first anniversary of the date of the notice for the preceding year’s annual meeting of stockholders (with adjustments if the date for the upcoming annual meeting of stockholders is more than 30 days from the anniversary date of the prior year’s annual meeting). |

Additionally, all director nominees submitted through these provisions must be independent and meet specified additional criteria. The maximum number of director nominees that may be submitted pursuant to these provisions may not exceed the greater of two directors or 20% of the number of directors then in office. The full text of our FifthSeventh Amended and Restated Bylaws, incorporatingwhich incorporates these proxy access provisions, is set forth at Appendix Awas filed as referencedExhibit 3.1 to a Form 8-K which we filed on August 4, 2023, in Proposal No. 4.connection with a subsequent revision to our bylaws, among other things. Executive Sessions of Non-Management Directors Our Corporate Governance Guidelines require the non-management directors serving on the Board to meet at regularly scheduled executive sessions without management participation and to hold an executive session at least once each year with only independent directors present. In accordance with such requirement, our non-management directors and/or our independent directors meet in executive sessions from time to time on such a basis. The executive sessions are chaired by our Lead Independent Director. Annual Elections; Majority Voting Each of our directors will be elected by our stockholders to serve until our next annual meeting of stockholders and until his or her successor is duly elected and qualified. Our bylaws provide for majority voting in uncontested director elections. Pursuant to our bylaws, in a contested election, directors are elected by a plurality of all of the votes cast in the election of directors, and in an uncontested election, a director is elected if he or she receives more votes for his or her election than votes against his or her election. Under our Corporate Governance Guidelines, any director who fails to be elected by a majority vote in an uncontested election is required to tender his or her resignation to our Board, subject to acceptance. Our Nominating and Corporate Governance Committee will make a recommendation to our Board on whether to accept or reject the resignation, or whether other action should be taken. Our Board will then act on our Nominating and Corporate Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of election results. If the resignation is not accepted, the director will continue to serve until the next annual meeting and until the director’s successor is duly elected and qualifies. The director who tenders his or her resignation will not participate in our Board’s decision.

2420| ir.pgre.com

|

| |

CORPORATE GOVERNANCE MATTERS

Anti-Hedging and Anti-Pledging Policy None of our executives have engaged in any hedging transactions with respect to our stock and none of our executives currently have engaged in any pledging transactionspledges with respect to our stock except as noted in “Security Ownership of Certain Beneficial Owners and Management.”place. Under our anti-hedging policy no executive or director may buy or sell puts, calls, other derivative securities of the Company or any derivative securities that provide the economic equivalent of ownership of any of the Company’s securities or an opportunity, direct or indirect, to profit from any change in the value of the Company’s securities or engage in any other hedging transaction with respect to the Company’s securities, at any time unless such transaction has been approved by the Nominating and Corporate Governance Committee. We also have an anti-pledging policy whereby no executive or director may pledge Company securities as collateral for a loan (or modify an existing pledge) unless the pledge has been approved by the Nominating and Corporate Governance Committee.

Forum Selection As a result of our stockholder engagement efforts and our commitment to corporate governance, the Nominating and Corporate Governance Committee did not recommend any changes to the forum selection provisions of our bylaws, as these provisions were most recently amended in February 2021. We continue to believe that our forum selection clause is appropriate.

Since we first adopted an exclusive forum provision under Article XV of our bylaws at the time of our initial public offering in 2014,2014. Since that time, Maryland has adopted a statute which confirms statutorily the acceptability of such provisions. Section 2-113 of the Maryland General Corporation Law (the “MGCL”), which became effective October 1, 2017, expressly provides that the charter or bylaws of a Maryland corporation may require that an “Internal Corporate Claim” (as defined below) be brought only in courts sitting in one or more jurisdictions specified in the charter or bylaws but must include the state and federal courts sitting in Maryland.

“Internal Corporate Claim” means a claim, including a claim brought by or in the right of a corporation: (a) based on an alleged breach by a director, an officer or a stockholder of a duty owed to the corporation or to the stockholders or breach by a director of a standard of conduct applicable to the director; (b) arising under the MGCL; or (c) arising under the charter or bylaws of the corporation.

Under our bylaws, as these provisions were amended by our Board in February 2021, derivative claims, Internal Corporate Claims, and all actions against the corporation, its directors, officers or employees must be brought in Maryland state court (or Maryland federal court if for some reason the state court does not have jurisdiction), and actions alleging violations of the Securities Act of 1933, as amended, can only be brought in federal, not state, court, but can be brought anywhere in the United States. These provisions apply unless we consent otherwise.

We believe that our forum selection provision in our bylaws balances competing interests fairly, granting our stockholders an opportunity to bring actions in our name or against us, but requiring use of courts which are likely to be most familiar with the issues, thus discouraging forum shopping, preserving our resources and ensuring access to justice in a manner we believe is appropriate. During various of our stockholder outreach discussions, we had an opportunity to discuss this provision with our major stockholders, and we believe that the vast majority of them are supportive of our approach. | | | |

| 20222024 Proxy Statement |2521

|

CORPORATE GOVERNANCE MATTERS

Minimum ShareStock Ownership Guidelines for Executive Officers and Directors We have adopted minimum stock ownership guidelines that require each executive officer to maintain a minimum number of shares of our common stock (including operating partnership units and LTIPT-LTIP units) having a value equal to or greater than a multiple (six times, in the case of our Chief Executive Officer, and three times, in the case of all other Section 16 executive officers) of such executive officer’s base salary. In calculating minimum stock ownership guidelines, we exclude stock options, time-based AOLTIP units (“T-AOLTIP units”) and performance-based AOLTIP units (“P-AOLTIP units”) and unearned performanceperformance-based LTIP units.units (“P-LTIP units”). Each executive officer mustwho was already employed by the Company when the guidelines were adopted in February 2016 was required to achieve the minimum equity investment within five years, fromby February 23, 2021, and did so. For each officer subsequently appointed, he or she must achieve the laterminimum level of the dateequity within five years of the adoption of the policy (for executive officers in place at that time) and the date of such officer’s appointment, (for subsequently appointed executive officers), and until such time as the executive officer achieves such minimum, he or she must retain 50 percent50% of the value of any vested award, net of taxes. We have also adopted minimum stock ownership guidelines thatfor our independent directors. These guidelines require our independent directors to hold a number of shares of our common stock (including operating partnership units and LTIP units) having a market value equal to or greater than five times the portion of the annual base retainer which is eligible to be paid in cash. In calculating minimum stock ownership guidelines, we exclude stock options, AOLTIP units and unearned performance LTIPP-LTIP units. Each independent director mustwho was serving when the guidelines were adopted was required to achieve the minimum equity investment withinby February 23, 2021, and did so. Those who were elected after the policy was adopted in February 2016 have five years from the later of the date of the adoption of the policy (for directors in place at that time) and the date of such director’stheir initial election to our Board (for subsequently appointed directors) to attain compliance with the stock ownership requirements. Risk Oversight Our Board is responsible for overseeing the Company’s risk management process. The Board focuses on the Company’s general risk management strategy and the most significant risks facing the Company and ensures that appropriate risk mitigation strategies are implemented by management. The Board also is apprised of particular risk management matters in connection with its general oversight and approval of corporate matters. The Board has delegated to the Audit Committee oversight of the Company’s risk management process.process to the Audit Committee. Among its duties, the Audit Committee reviews with management (a) the CompanyCompany’s policies with respect to risk assessment and management of risks that may be material to the Company, including cybersecurity and enterprise risk management, (b) the Company’s system of internal controls over financial reporting and (c) the Company’s compliance with legal and regulatory requirements. During a typical quarterly meeting, the Audit Committee will invite one of the Company’s functional department heads (Leasing, Human Resources, Information Technology, Property Management, etc.) to present an overview of their operations, including staffing and risks inherent in each functional area, and how these are managed. In this way, the committee garners a good understanding of how risks arise throughout the business and what management’s mitigation strategies are. Periodically, the Audit Committee will also engage external firms to provide additional diligence and analysis. For example, the Audit Committee has in the past reviewed one or more third-party assessments of our cybersecurity program and reported these results to the Board. 22| ir.pgre.com |

| |

CORPORATE GOVERNANCE MATTERS

The Nominating and Corporate Governance Committee regularly receives memoranda or briefings by legal advisors on topics such as governance trends, and at least annually reviews with the Company’s general counsel and compliance officer, who reports to the Chairman, Chief Executive Officer and President in these roles, the Company’s compliance with legal and regulatory requirements, including its annual training program covering, among other things, the Code of Business Conduct and Ethics, the Insider Trading Policy, and the process for employees to file complaints for potential investigation by the legal department or outside advisors, as warranted. In addition, the Compensation Committee considers the risks to the Company’s stockholders and in achieving the Company’s goals that may be inherent in its compensation program. Our other Board committees also consider and address risk as they perform their respective committee responsibilities. For example, the Investment and Finance Committee will regularly consider upcoming debt maturities of the Company and its subsidiaries, and any associated derivatives in place and hedging policies and procedures related thereto. When potential acquisitions, dispositions, or financings within its jurisdiction are presented to the committee, or to the Board, risks inherent in these transactions (e.g., market risk, leasing risk, financing risks, counterparty risks) are explicitly identified so that each risk which can be mitigated can be properly dealt with and appropriate conditions imposed to the consummation of each transaction. All committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise level risk. In addition, the Compensation Committee considers the risks to the Company’s stockholders and to achievement of our goals that may be inherent in the Company’s compensation program.

The Company’s management is responsible for day-to-day risk management, including the primary monitoring and testing function for companywide policies and procedures, and management of the day-to-day oversight of the risk management strategy for the ongoing business of the Company. This oversight includes identifying, evaluating and addressing potential risks that may exist at the enterprise, strategic, financial, operational and compliance and reporting levels. On an approximately biennial basis, this includes requiring selected managers to complete a formal survey of common risk topics that are ranked by potential likelihood and impact, with the most important topics then further dimensioned by management and assigned to one or more specific senior executives for mitigation and monitoring by the CEO, COO and Audit Committee, as needed. We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing the Company and that our Board leadership structure supports this approach.

| | | |

| 2024 Proxy Statement |23

|

CORPORATE GOVERNANCE MATTERS

Director On-Boarding and Continuing Education

Pursuant to our Corporate Governance Guidelines, the Board has an orientation and on-boarding program as part of its effort to integrate new directors in their role and familiarize them with the company.Company. We also provide continuing education for all directors.

For new directors, our orientation program is tailored to the needs of each new director depending on his or her level of experience serving on other boards and knowledge of the companyCompany or industry acquired before joining the Board. Materials provided to new directors include information on the company’sCompany’s business plan, financial matters, corporate governance practices, the Code of Business Conduct and Ethics, the Insider Trading Policy, and other key policies and practices. New directors are typically already familiar with the members of our Nominating and Corporate Governance Committee, but also meet with the Chairman, Chief Executive Officer and President before their first boardBoard meeting and may also be assigned an existing director as a mentor. New Audit Committee members are provided with orientation materials targeted to that role provided by representatives from our independent registered accounting firm. For all directors, representatives of management brief the Board regularly on topics designed to provide directors a deeper understanding of various aspects of our business. Continuing director education is provided during portions of Board and committee meetings and other Board discussions. Our focus is on items necessary to enable the Board to consider effectively longer-term strategic issues and topics that address their fiduciary responsibilities. DuringFor example, during 2021, for example, the Board received a presentation from our Chief Information and Technology Officer on our cybersecurity protection program.program and then, as referenced above, the Audit Committee, which has been charged by our Board with overseeing cybersecurity risk, in each of 2022 and 2023, reviewed results from third-party assessments of various aspects of our cybersecurity program maturity and reported these results to the Board. In priorother years, directors have been briefed on the status of the San Francisco real estate market and on capital market activities in the REIT sector. The Audit Committee devotes time to educating committee members about various operational risk as well as new accounting rules and standards, and other topics necessary to having a good understanding of our accounting practices and financial statements. The Nominating and Corporate Governance Committee regularly receives memoranda or briefings by legal advisors on topics such as governance trends. All of our directors are invited for tours of our properties, typically in the city where a Board meeting is occurring, or after a new acquisition. Our Board’s engagement in the company’sCompany’s business, such as these on-site visits at our properties, provides it with useful information and perspectives.

24| ir.pgre.com

|

| 2022 Proxy Statement |27

|

PROPOSAL 1: ELECTION OF DIRECTORS The Board currently consists of nineten members. Each member of the Board is serving (or will serve) for a term of one year and until his or her successor is duly elected and qualified. Their term expires at each annual meeting of stockholders. Our charter and bylaws provide that a majority of the Board may at any time increase or decrease the number of directors. However, the number of directors may never be less than the minimum number required by the MGCL, which is one, and unless our bylaws are amended, more than nine. Colin Dyerten. Peter Linneman will not be standing for election at the 20222024 annual meeting. At the 20222024 annual meeting, all of the directors will be elected to serve until the 20232025 annual meeting and until their successors are duly elected and qualified. The Board, upon the recommendation of the Nominating and Corporate Governance Committee, has nominated the following to serve as directors: | | | | ● Karen KleinKatharina Otto-Bernstein

| ● Mark PattersonPaula Sutter

| | ● Peter LinnemanMark Patterson

| ● Hitoshi SaitoGreg Wright

| | ● Katharina Otto-BernsteinHitoshi Saito

| | | ● Greg WrightNadir Settles

| |